‘VFR’ refers to ‘visiting friends and relatives’ and it was the purpose behind 20% of total international departure travel in 2020. The desire to reconnect with family and friends after a year of stringent lockdown measures due to Covid-19 is likely greater than a leisure getaway in 2021. Therefore, its power should not be underestimated in driving travel’s recovery.

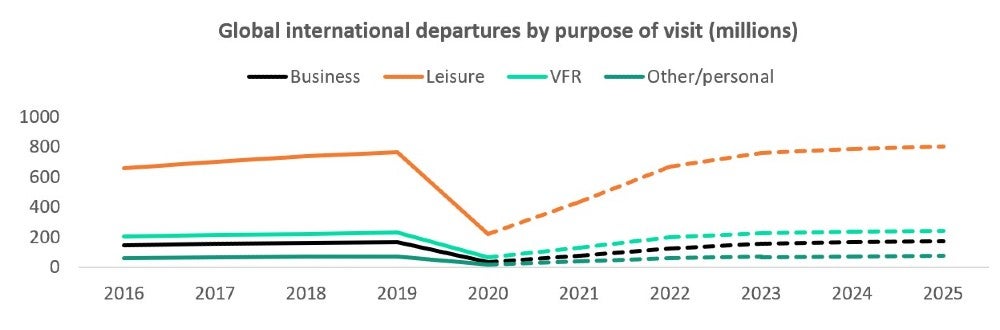

VFR is a vital motivation for travel and the impact of Covid-19 has taken the freedom of movement away for families to reunite. In 2019, VFR travel accounted for 230 million international departures worldwide. Its share of international departures (18%) is not as sizable as the leisure market (65%) and is commonly the second most popular reason for travel. 2020 saw international departures for VFR decline by -70% due to the Covid-19 pandemic, with only 69.2 million international departures taking place for this purpose. GlobalData’s forecast suggests that VFR travel will experience higher growth (CAGR 2021-25: 17%) than leisure (CAGR 2021-25: 16.4%) over the next four years. Even though it will not surpass the number of international leisure getaways, it will play a vital role in travel’s recovery with 242 million international departures travelling globally for this purpose by 2025.

VFR was the second most typically taken holiday in 2019 by global respondents (46%) in GlobalData’s Q32019 consumer survey*, second to ‘sun and beach getaways’ (58%). Even though a year of travel restrictions and more time at home may mean the desire for typical sun, sea and sand holidays will be strong, visiting family and friends is likely a greater priority for many right now. In certain source markets, it is also the most popular and primary reason for travel including the USA (53%), Australia (52%), Canada (49%), India (64%) and Saudi Arabia (60%).

The current situation for 55% of global respondents in GlobalData’s Q2 2021 consumer survey** was staying at home as much as possible. The same survey also revealed that 83% of global respondents were ‘extremely’, ‘quite’ or ‘slightly’ concerned about restrictions on socialising with friends and family. Opportunities to socialise virtually with platforms such as Zoom, Facebook, WhatsApp, etc. have been high in demand. These platforms have given consumers an opportunity to meet virtually. However, this still isn’t the same as embracing a family member or properly sitting down together and the desire to do this is likely to fuel the increased demand for VFR travel.

During this pandemic, travel and tourism bodies worldwide have called for the sector to ‘reunite in its recovery’. The aim for both destinations and tourism businesses right now should be to reunite families after over a year of international travel restrictions. Destinations can issue special visas or requirements that will make it easier for families to reunite. Airlines can ensure popular VFR routes are some of the first to be restored, hospitality businesses and attraction operators could offer incentives and discounts for families. All industries across the travel sector could be better informed to have a greater understanding of this tourism market.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData*GlobalData’s Q32019 consumer survey – 29,744 respondents

** GlobalData’s Q2 2021 consumer survey – 22, 338 respondents

Related Company Profiles

Zoom Corporation

VFR, LLC

WhatsApp Inc.