Subscription services have disrupted almost every industry, but the customer-focused model remains relatively nascent in the travel industry. Its popularity could rise as travel subscriptions represent a compelling way for businesses to build brand loyalty and for travellers to gain access to personalised content and discounted prices.

Travel subscriptions on the rise

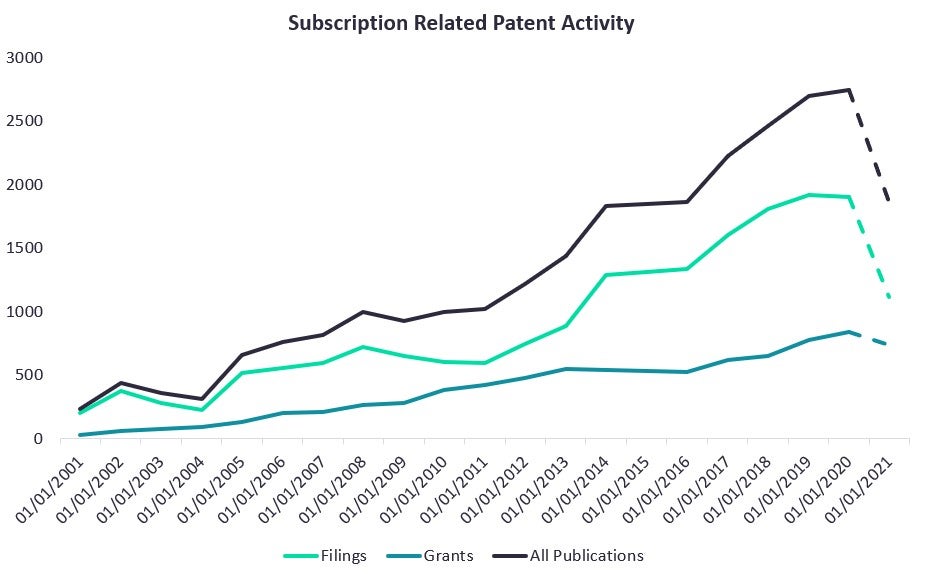

More and more businesses are moving away from the traditional product economy to the ‘subscription economy’. EDreams ODIEGO Prime subscription reportedly reached two million members just six months after hitting one million in May 2021 while more niche and targeted subscriptions are entering the market from the likes of Inspirato, Regenerative Travel and Bidroom. Further demonstrating the shift from the traditional economy and mainstream shift from loyalty points to subscriptions, is increased patent activity for subscriptions (CAGR 2016-19: 13.1%). According to GlobalData’s Patent Analytics*, a total of 2,749 publications were made in 2020, with growth continuing even throughout Covid-19. Travel companies investing in subscription services will emerge from the pandemic in a strong position to attract the tech-savvy and deal-finding traveller.

Subscriptions could overcome revenue fluctuations and build brand loyalty

Some companies integrate subscriptions to their mix of revenue streams, while others will go to market with it as a foundational offering. Regardless, Covid-19 has highlighted the need for more a predictable and recurring revenue stream for travel companies as the likes of Bookings Holdings and Expedia Group saw its revenues drop more than 50% YoY in 2020 when travel came to a virtual standstill. Subscription models have the potential to completely transform an industry that faces challenges such as seasonality and the growth-decline cycles of bookings and commissions by ensuring a relatively predictable and stable revenue stream.

Subscriptions represent a compelling way for travel companies to create lasting relationships where engagement typically ends after a one-off transactional purchase, and loyalty was historically linked to points programs and air miles. However, travel players are now defying the conventional wisdom by attracting travellers with paid subscription programs, which generally promise exclusive discounts and perks, as well as personalized travel advice.

Travellers want personalisation and greater brand interaction

Now more than ever, travellers want personalisation and greater brand interactions. As per GlobalData’s Q1 2021 Consumer Survey** 53% of global respondents were ‘always’ or ‘often’ influenced by how well a product/service is tailored to their needs and personality. Meanwhile, 25% of respondents consider the ability to engage with a brand directly an essential driver of purchase. Subscription platforms are well placed to capitalize on this trend given the more personal relationship it has with customers.

See Also:

Furthermore, the value and convenience enjoyed by members have the potential to outweigh a monthly subscription or membership fee. When booking online, consumers are frequently presented with thousands of options, resulting in consumers feeling overwhelmed and choice overload. In addition, to gaining access to discounted prices on holiday products, the appeal of travel subscriptions is the personalization and dedicated care teams of some platforms, which can offer time-saving benefits.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData*GlobalData Patent Analytics

**GlobalData’s Q1 2021 Consumer Survey – 21,768 respondents

Related Company Profiles

Expedia Group Inc