On the face of it, 2008 will be an exciting year for the global airport industry. The biggest and most advanced airport building in the world will open in Beijing, terminal five will finally open at London Heathrow and the Open Skies agreement should foster greater travel opportunities between the UK and the US.

Industry trend watchers Air4casts suggest that global passenger numbers will increase by 5.1% to 4,694.7 million in 2008. However, levels of growth will vary dramatically depending on geographic area.

“The glory days will be in the Middle East and Asia Pacific,” says Peter Morris, chief economist at industry analysts Ascend. “India can expect growth of around 30%, China 15% and the Middle East 12% whereas Europe will get around 5% and the US domestic market will be really flat, around 1%-2%.”

So what, exactly, will the new airports and terminals opening next year add to the industry? What can we expect in terms of new technology and regulations? And will rising oil prices finally impact on demand?

AIRPORT UPGRADES

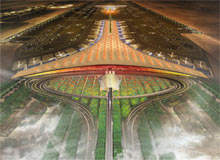

One of the most impressive upgrades of 2008 will be at Beijing Airport in China, where a new international terminal will open in time to welcome athletes and sports fans from around the world to the Olympics in August. Billed as the biggest and most advanced airport building in the world, the terminal has a floor area of over one million square metres and can accommodate 43 million passengers a year, rising to 53 million by 2015.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataDesigned by Foster + Partners and built by a range of contractors, including Arup, in four years, the terminal will feature a soaring aerodynamic roof and traditional Chinese colours and symbols.

It will be one of the most sustainable airport buildings in the world, incorporating a range of passive environmental design concepts like heat-gain-maximising skylights and an integrated environment-control system that minimises energy consumption and carbon emissions.

TERMINAL FIVE

Equally impressive will be the opening of Heathrow’s terminal five in March. Billed as a new landmark for London, T5 comprises a main terminal building, two satellite buildings (one of which will not open until 2011), 60 aircraft stands, a new air traffic control tower, a 4,000-space multi-storey car park and a 600-bed hotel. To aid construction builders have had to create of a new spur road from the M25, divert two rivers and bore over 13km of tunnel.

BAA has invested £4.2bn in the project and will transfer its entire operation, currently housed in terminals one and four, to T5. As a result, BAA will be able to upgrade the remaining terminals, bringing the buildings in line with Heathrow’s status as a world-leading airport.

In the US a swathe of new airport terminals that were rubber-stamped in the pre-9/11 days, when domestic demand was higher than it is now, are due to open this year.

Jet Blue, the airline that overtook American as the top carrier in terms of passengers, is getting a new $875m terminal at JFK. Indianapolis and Detroit Metropolitan will also benefit from new terminals whilst San Bernardino International in California will become a passenger airport for the first time in its history.

NEW AIRPORTS

The two biggest new airport openings of 2008 will happen within weeks of each other in India. In March the Rs17.6bn Hyderabad International Airport will open, followed swiftly by the Rs14.7bn Bangalore International.

Hyderabad will feature the longest runway in South Asia (4,260m) and a 105,300m² terminal capable of handling seven million passengers a year. Eventually the terminal will be 900,000m² and capable of handling 40 million passengers a year.

The much-delayed Bangalore International, which was conceived in 1993, is finally set to open in April with terminal buildings covering 46,000m². The airport will handle 11 million passengers a year at a rate of 27 aircraft an hour.

Meanwhile, the world’s second highest airport will open in May in the Sichuan province of China. Standing 4,280m above sea level, the airport cost £62m to build and will be capable of handling 330,000 passengers a year.

NEW MOVEMENTS

A new agreement between the EU and the US, effective from March 2008, will smash the stranglehold of a select band of air carriers on transatlantic flights and could lead to cheaper airfares. Currently, only British Airways, Virgin Atlantic, American Airlines and United Airlines can fly between Heathrow and the US.

However, under the Open Skies agreement, any EU-based airline will be able to fly from any city in the EU to any city in the US. The cost of transatlantic travel is expected to fall due to the increase in competition.

“This was a brave move in the face of stiff opposition from the two UK airlines that have for years enjoyed a protected transatlantic market from Heathrow,” says BMI’s chief executive officer Nigel Turner. “UK travellers alone could save up to £250m a year, as identified by the UK Civil Aviation Authority (CAA).”

Another Open Skies agreement has been agreed between the UK and Singapore. It will also become effective from March 2008 and it is hoped that increased competition will lead to wider choice and cheaper fares for travellers.

OWNERSHIP

The trend towards privatisation in the airport industry is likely to continue in 2008. According to analysts Frost and Sullivan, only 2% of the world’s airports were privately owned in 2006. However, with budget constraints hindering the progress of airports seeking to accommodate increasing passenger traffic, they anticipate more airports turning to the private sector in the future.

Prague and Faisalabad airports are expected to be privately owned by the end of 2008, whilst Portugese operator ANA and Iran Air are also expected to transfer to private sector ownership.

“There are a number of examples of highly successful takeovers of state-owned facilities by companies with airport operations experience,” says Peter Morris. “By treating an airport as a business, performance can be improved dramatically.”

TECHNOLOGY

The major innovations in technology in 2008 will come in the airport security sector. Analysts Frost & Sullivan predict that in Europe alone, airport security revenues will quadruple from $2.37bn in 2005 to $10.35bn by 2010, with the biggest growth occurring in the biometrics and explosive detection sub-sectors. In the US, 2007 began with one airport using Clear’s biometric technology; 2008 will begin with 14 airports using it with bids underway for three more.

The growth in airport security is being driven by continued terrorist threats, European Union (EU) airport security regulations passed in 2005, rising passenger traffic and the increasing need to upgrade installed security equipment, as well as integrate this with newly implemented technology.

In terms of brand-new technology; the US Homeland Security Department will trial a new screening device at Sunport Airport in Albuquerque in summer 2008 that could, if successful, signal the end of current hand luggage restrictions. The new technology uses magnetic resonance imaging (MRI) to spot liquid explosives contained within luggage.

Heathrow’s new terminal five will feature the most technologically advanced car park in the world. The automated system will take a photo of each car’s license plate as it enters, and direct the driver to a vacant space using illuminated arrows and an infrared camera tracking system. The car park ticket will retain details of the parking space, so when the user returns to the pay kiosk, a digital display will direct the driver to the car. Officials claim the system will reduce traffic and cut carbon emissions by 397t a year.

REGULATIONS

New regulations mean 2008 should be a good year for disabled travellers in the UK. From July, every airport that carries more than 150,000 passengers a year will need to have arrangements in place that enable disabled travellers to board, disembark and transit between fights, without charge.

All staff will receive disability awareness training and refresher training and will have to assist passengers with mobility impairments to get to the toilet, and provide essential information, such as safety guidance, in an accessible format. They will also need to take ‘reasonable steps’ to accommodate the seating needs of disabled passengers.

Also in the UK, the government has reacted to growing concerns about the aviation industry’s impact on the environment by vowing to replace the current airport departure tax (APD) with a per-plane tax in 2009. However, the tax will remain frozen in 2008.

NEGATIVES

In the UK, the CAA is proposing to increase landing charges at Heathrow by 16% to £11.97 in 2008/9, with Gatwick rising 8.2% to £6.07. Whilst this may not represent a big problem to the industry, there is a dark cloud on the horizon that could cause greater problems: rising oil prices.

“Oil prices have risen three to four times since 2002 and it is remarkable that so far it has had little impact on the industry,” says Peter Morris. “In fact, more airlines have joined the party in that time than have gone out of business. However, we’ve reached the point now where, in 2008, increases in oil prices will have to be passed onto the passengers. That could seriously hurt demand.”

However, a BA spokesman dismissed the threat. “We constantly monitor oil and react accordingly,” he said.