The aerospace and defence industry continues to be a hotbed of innovation, with the conflict in Ukraine driving defence spending and investment, the need to combat emerging technologies such as hypersonics, and growing importance of technologies such as AI and computer vision. In the last three years alone, there have been over 174,000 patents filed and granted in the aerospace and defence industry, according to GlobalData’s report on Robotics in Aerospace, Defence & Security: Satellite constellation control systems. Buy the report here.

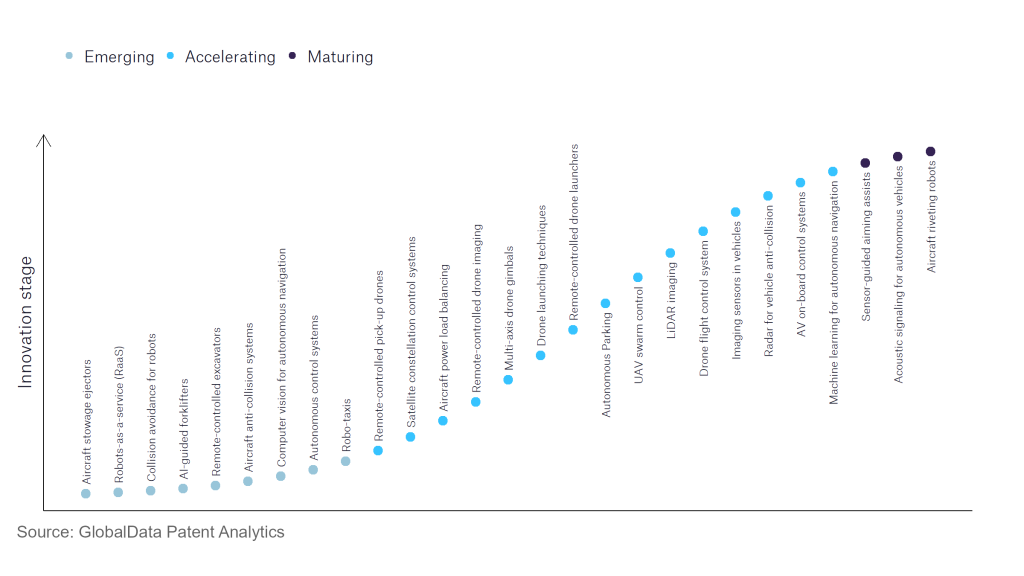

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

180+ innovations will shape the aerospace and defence industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the aerospace and defence industry using innovation intensity models built on over 262,000 patents, there are 180+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, collision avoidance for robotics, computer vision for autonomous navigation and autonomous control systems are disruptive technologies that are in the early stages of application and should be tracked closely. Remote-controlled pick-up drones, satellite constellation control systems and imaging sensors in vehicles are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are sensor-guided aiming assists and acoustic signalling for autonomous vehicles, which are now well established in the industry.

Innovation S-curve for robotics in the aerospace and defence industry

Satellite constellation control systems is a key innovation area in robotics

A satellite constellation describes a network of artificial satellites working together and can be used to provide a permanent global or near global coverage where one satellite is also providing coverage.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 40+ companies, spanning technology vendors, established aerospace and defence companies, and up-and-coming start-ups engaged in the development and application of satellite constellation control systems.

Key players in satellite constellation control systems – a disruptive innovation in the aerospace and defence industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to satellite constellation control systems

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Boeing | 205 | Unlock Company Profile |

| Airbus | 181 | Unlock Company Profile |

| Thales | 176 | Unlock Company Profile |

| Safran | 111 | Unlock Company Profile |

| Mitsubishi Electric | 93 | Unlock Company Profile |

| Maxar Technologies | 86 | Unlock Company Profile |

| Northrop Grumman | 77 | Unlock Company Profile |

| ArianeGroup | 74 | Unlock Company Profile |

| Lockheed Martin | 62 | Unlock Company Profile |

| Raytheon Technologies | 55 | Unlock Company Profile |

| Honeywell International | 53 | Unlock Company Profile |

| Telesat Canada | 39 | Unlock Company Profile |

| IHI | 38 | Unlock Company Profile |

| Bharti Global | 33 | Unlock Company Profile |

| Planet labs | 24 | Unlock Company Profile |

| Beijing Aerospace Propulsion Technology | 24 | Unlock Company Profile |

| Bradford Engineering Holding | 19 | Unlock Company Profile |

| Mitsubishi Heavy Industries | 18 | Unlock Company Profile |

| Deutsches Zentrum fur Luft- und Raumfahrt | 15 | Unlock Company Profile |

| Ministry of Education, Culture, Sports, Science and Technology, Japan | 15 | Unlock Company Profile |

| Swarm Technologies | 11 | Unlock Company Profile |

| D-Orbit | 10 | Unlock Company Profile |

| Skeyeon | 10 | Unlock Company Profile |

| NovaWurks | 10 | Unlock Company Profile |

| Draper Laboratory | 10 | Unlock Company Profile |

| United Launch Alliance | 9 | Unlock Company Profile |

| National Aeronautics and Space Administration | 9 | Unlock Company Profile |

| MBDA Holdings | 8 | Unlock Company Profile |

| Momentus | 7 | Unlock Company Profile |

| Blue Origin | 7 | Unlock Company Profile |

| OHB | 7 | Unlock Company Profile |

| Effective Space Solutions | 7 | Unlock Company Profile |

| Orbit Fab | 6 | Unlock Company Profile |

| Urugus | 5 | Unlock Company Profile |

| Methera Global Communications | 5 | Unlock Company Profile |

| Environmental Science Associates | 5 | Unlock Company Profile |

| Ball | 5 | Unlock Company Profile |

| Effective Space Solutions R&D | 5 | Unlock Company Profile |

| EchoStar | 5 | Unlock Company Profile |

| Advent International | 5 | Unlock Company Profile |

| UrtheCast | 5 | Unlock Company Profile |

| Skycorp | 5 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Boeing is the largest patent filer in the satellite constellation control systems sector. The company aims to boost connectivity by developing these networks and provides solutions to commercial and military users. It leverages satellites in low or medium earth orbit and has launched 50 to date. The company has a specific business in government satellites which can support intelligence surveillance and reconnaissance (ISR) capabilities. The second largest patent filer in the sector is Airbus, which operates a network of optical and radar commercial earth observation satellites for use across various industries.

In terms of application diversity, Bradford Engineering Holding leads the pack, with MBDA and Ball in second and third place, respectively. By geographic reach, MBDA is top, followed by OHB and Telesat Canada.

There is significant military scope in terms of ISR applications for this technology. Whilst the development costs of these networks are significant, they can provide significant benefits for users.

To further understand the key themes and technologies disrupting the aerospace and defence industry, access GlobalData’s latest thematic research report on Defence.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.