The aerospace and defenceindustry continues to be a hotbed of innovation, with activity driven by the uptake of advanced technology, and growing importance of technologies such as hypersonics and advanced materials. In the last three years alone, there have been over 174,000 patents filed and granted in the aerospace and defence industry, according to GlobalData’s report on Innovation in Aerospace, Defence & Security: Composite laminates for aircraft parts. Buy the report here.

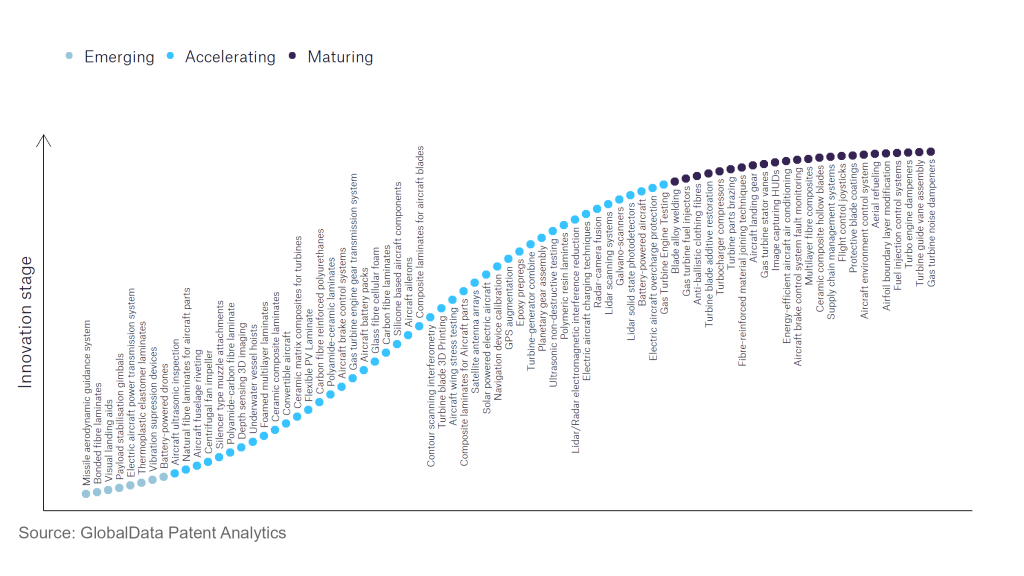

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

180+ innovations will shape the aerospace and defence industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the aerospace and defence industry using innovation intensity models built on over 262,000 patents, there are 180+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, bonded fibre laminates, thermoplastic elastomer laminates, and vibration supression devices are disruptive technologies that are in the early stages of application and should be tracked closely. Centrifugal fan impellers, ceramic composite laminates, and gas turbine engine testing are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are protective blade coatings and blade alloy welding, which are now well established in the industry.

Innovation S-curve for the aerospace and defence industry

Composite laminates for aircraft parts is a key innovation area in aerospace and defence

A composite laminate is made up of different layers of fibrous composite materials, examples of these which are used in aircraft manufacturing include fibreglass, carbon fibre and glass fibre.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 50+ companies, spanning technology vendors, established aerospace and defence companies, and up-and-coming start-ups engaged in the development and application of composite laminates for aircraft parts.

Key players in composite laminates for aircraft parts – a disruptive innovation in the aerospace and defence industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to composite laminates for aircraft parts

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Boeing | 273 | Unlock Company Profile |

| Airbus | 84 | Unlock Company Profile |

| Safran | 51 | Unlock Company Profile |

| Modern Meadow | 44 | Unlock Company Profile |

| Compagnie de Saint-Gobain | 36 | Unlock Company Profile |

| Textron | 28 | Unlock Company Profile |

| Mitsubishi Heavy Industries | 26 | Unlock Company Profile |

| Tenneco | 26 | Unlock Company Profile |

| Raytheon Technologies | 23 | Unlock Company Profile |

| Albany International | 19 | Unlock Company Profile |

| Smiths Group | 18 | Unlock Company Profile |

| Elbit Systems | 18 | Unlock Company Profile |

| Spirax-Sarco Engineering | 16 | Unlock Company Profile |

| Hutchinson | 15 | Unlock Company Profile |

| Diehl Aircabin | 12 | Unlock Company Profile |

| Tecalemit Aerospace | 12 | Unlock Company Profile |

| DAHER Aerospace | 11 | Unlock Company Profile |

| Goodyear | 11 | Unlock Company Profile |

| Lightweight Labs | 11 | Unlock Company Profile |

| Daikin Industries | 10 | Unlock Company Profile |

| General Motors | 10 | Unlock Company Profile |

| Advanced Composite Structures | 10 | Unlock Company Profile |

| Carbon Revolution | 10 | Unlock Company Profile |

| Israel Aerospace Industries | 9 | Unlock Company Profile |

| Wing Aviation | 9 | Unlock Company Profile |

| Honeywell International | 9 | Unlock Company Profile |

| Baker Hughes | 9 | Unlock Company Profile |

| General Electric | 9 | Unlock Company Profile |

| 3M | 8 | Unlock Company Profile |

| Proprietect | 8 | Unlock Company Profile |

| Xerox Holdings | 8 | Unlock Company Profile |

| Sumitomo Electric Industries | 8 | Unlock Company Profile |

| Toray Industries | 8 | Unlock Company Profile |

| Ultra Electronics Holdings | 8 | Unlock Company Profile |

| European Aeronautic Defence and Space Company | 8 | Unlock Company Profile |

| Crompton Technology Group | 7 | Unlock Company Profile |

| Northrop Grumman | 7 | Unlock Company Profile |

| Shanghai Electric Group | 7 | Unlock Company Profile |

| Lockheed Martin | 7 | Unlock Company Profile |

| Ube Industries | 7 | Unlock Company Profile |

| Fujifilm Holdings | 6 | Unlock Company Profile |

| Spirit AeroSystems Holdings | 6 | Unlock Company Profile |

| ThyssenKrupp | 6 | Unlock Company Profile |

| Ford Motor | 6 | Unlock Company Profile |

| Toyota Motor | 6 | Unlock Company Profile |

| Nitto Denko | 6 | Unlock Company Profile |

| General Dynamics | 6 | Unlock Company Profile |

| Diehl Aviation Laupheim | 6 | Unlock Company Profile |

| CEA | 6 | Unlock Company Profile |

| Dow | 5 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Safran is the leading patent filer in composite laminated for aircraft parts, the invention of new composite laminates can provide increased strength whilst not increasing the overall weight of the aircraft. Composite laminates have been significant in reducing aircraft weight, providing cost saving solutions to customers – they also have applications in reducing maintenance costs and providing additional benefits. Other leading patent filers in the sector include Boeing and Airbus, signifying that leading aerospace companies are filing patents in order to advance technology within the sector.

In terms of application diversity, HANKOOK is the leader, followed by Siemens and IHI. By geographic reach, Unifrax is the leader, followed by Fischer Advanced Composite Components and MITSUYA.

Patents filed in this sector will have a significant impact on aircraft modernisation in future and provide solutions across commercial and military aerospace.

To further understand the key themes and technologies disrupting the aerospace and defence industry, access GlobalData’s latest thematic research report on Defence.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.