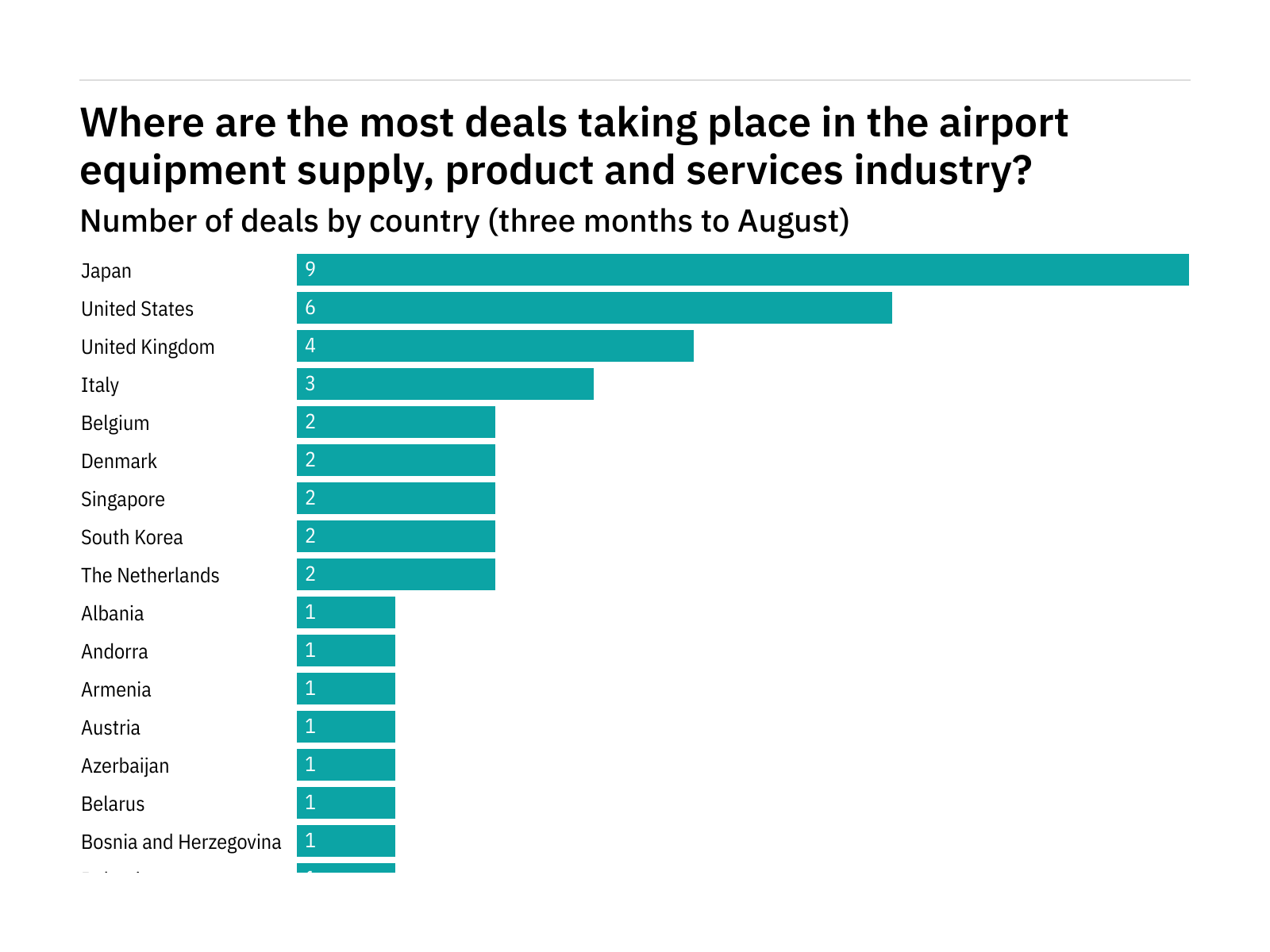

There were 32 deals recorded involving top airport equipment supply, product and services companies in the three months to April with a number of high profile partnership, merger, sponsorship, venture financing, asset transaction, debt offering, acquisition and private equity deals.

That’s according to GlobalData’s Financial Deals database, which tracks market activity across a variety of sectors and deal types.

The deals below only include those that have been completed – so excludes rumours or those that have been agreed but not yet executed.

The figures, which cover the top airport equipment supply, product and services companies, show the market in Japan to be the most active, with nine deals taking place over the last three months. That was followed by the US, which saw six deals.

Below are some of the largest completed deals to have taken place in the last quarter.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAcquisitions

Spirit Airlines Rejects Takeover Offer from JetBlue Airways - 05 April ($7,300m)

Spirit Airlines, Inc, an ultra-low-cost carrier, has rejected the takeover offer received from JetBlue Airways Corp, a passenger carrier company, to acquire Spirit Airlines in an all-cash transaction for USD33 per share, saying it had a low likelihood of winning approval from government regulators.

Spirit intended to engage in discussions with JetBlue with respect to JetBlue's proposal, in accordance with the terms of Spirit Airlines' merger agreement with FGH.

The proposal represented a premium of 52% to Spirit's undisturbed share price on February 4, 2022, and a premium of 50% to Spirit's closing share price on April 4, 2022.

The enterprise value of Spirit Airlines was USD7.3 billion.

Barclays Plc and Morgan Stanley & Co Ltd acted as financial advisors, while Debevoise & Plimpton LLP is acted as legal advisor to Spirit Airlines. Goldman Sachs & Co. LLC acted as a financial advisor, while Shearman & Sterling LLP is acted as legal advisor to JetBlue Airways.

JetBlue intended to fund the transaction with cash on hand and debt financing led by Goldman Sachs & Co. LLC.

Deal History:

Updated: On April 07, 2022, Spirit Airlines Inc has announced that its Board of Directors has determined, after consultation with Spirit Airlines's outside financial and legal advisors, that the unsolicited proposal received from JetBlue Airways Corp, a passenger carrier company, to acquire Spirit Airlines in an all-cash transaction for USD33 per share could reasonably be likely to lead to a 'Superior Proposal' as defined in Spirit's merger agreement with Frontier Group Holdings, Inc. (FGH), the parent company of Frontier Airlines, Inc.

Announced: On April 5, 2022, JetBlue Airways submitted an unsolicited proposal to acquire all of the outstanding shares of Spirit Airlines, Inc, an ultra-low-cost carrier, for USD33 per share in cash, implying a fully diluted equity value of USD3.6 billion and providing full and certain value to Spirit shareholders.

Earlier On February 7, 2022, Spirit entered into a merger agreement with Frontier Group Holdings, Inc., under which Spirit and Frontier would combine in a stock and cash transaction. Under the terms of the merger agreement, Spirit equity holders would receive 1.9126 shares of Frontier plus USD2.13 in cash for each existing Spirit share they own. The transaction is subject to customary closing conditions, including completion of the regulatory review process and approval by Spirit stockholders.

Agility Public Warehousing to Acquire 100% Stake in John Menzies - 30 March ($1,000m)

Agility Public Warehousing Co, a Kuwait-based logistics services provider, has entered into an agreement to acquire 100% stake in John Menzies Plc, a UK-based logistics and airport services company, for GBP763 million.

The Combined Group will be wholly owned by Agility.

The deal values Menzies at approximately GBP571 million on a fully diluted basis and at approximately GBP763 million on an enterprise value basis.

It is intended that the Combined Group will use the globally-recognised 'Menzies' and 'Menzies Aviation' brands following completion of the acquisition.

Goldman Sachs International and Moelis & Company Holdings LP are acting as financial advisors and DLA Piper UK LLP is as legal advisor to Menzies.

Barclays Plc is acting as financial advisor and Latham & Watkins LLP is acting as legal advisor to Agility.

Stagecoach Terminates Agreement to be Acquired by National Express - 09 March ($643m)

Stagecoach Group plc, a public transport operator, with bus, coach and rail services, has terminated the agreement to be acquired by National Express Group plc, a public transport operator, with bus, coach and rail services, for GBP470 million (USD642.85 million). Both companies involved in the transaction are based in the UK.

Under the terms of the Potential Combination, it is expected that Stagecoach shareholders would receive 0.36 new National Express ordinary shares for each Stagecoach ordinary share, resulting in them owning approximately 25 per cent. Of the Combined Group.

BofA Securities, HSBC, Maitland/AMO, Ashurst LLP are acting advisors to National Express.

Deal History:

Announcement: On December 14, 2021, National Express Group plc, has announced to acquire Stagecoach Group plc, for GBP470 million.

Rumor: On September 23, 2021, National Express Group plc, a public transport operator, with bus, coach and rail services, may acquire Stagecoach Group plc, a public transport operator, with bus, coach and rail services.

Hoban Construction to Acquire 13.97% Stake in Hanjin KAL - 29 March ($462m)

Hoban Construction Co., Ltd. (Hoban Group), a company engaged in construction business, has announced to acquire 13.97% stake in HANJIN KAL Corp., a company engaged in the airline, hotel, and travel related services, for a consideration of KRW564 billion (USD462.48 million). Both companies invovled in the transaction are based in South Korea.

The transaction is expected to be completed by April 4, 2022.

ID Logistics Acquires 100% Stake in Kane Logistics - 14 February ($240m)

ID Logistics Group, a France-based provider of contract logistics services, has acquired 100% stake in Kane Inc (Kane Logistics), a US-based contract logistics company, from Harkness Capital Partners LLC, a US-based private equity firm, for USD240 million in cash.

Kane Logistics' management team will manage all ID Logistics US activities.

Stan Schrader, Chief Commercial Officer of Kane Logistics, is now CEO of ID Logistics US.

Deal History:

Announcement On, February 14, 2022, ID Logistics has signed an agreement to acquire 100% stake in Kane, from Harkness Capital Partners LLC, for USD240 million in cash.

Mergers

Frontier Group Holdings to Merge With Spirit Airlines - 07 February ($6,600m)

Frontier Group Holdings, Inc. (FGH), a company engaged in providing airline services, has entered into a definitive agreement to merge with Spirit Airlines, Inc, an ultra-low-cost carrier. Both the companies are based in the U.S.

Upon closing of the transaction, existing Frontier equity holders will own approximately 51.5% and existing Spirit equity holders will own approximately 48.5% of the combined airline, on a fully diluted basis, providing both Frontier and Spirit equity holders with substantial upside potential.

Under the terms of the merger agreement, which has been unanimously approved by the boards of directors of both companies, Spirit equity holders will receive 1.9126 shares of Frontier plus USD2.13 in cash for each existing Spirit share they own. This implies a value of USD25.83 per Spirit share at Frontier's closing stock price of USD12.39 on February 4, 2022, representing a premium of 19% over the February 4, 2022, closing price of Spirit, and a 26% premium based on the 30 trading-day volume-weighted average prices of Frontier and Spirit. The transaction values Spirit at a fully diluted equity value of USD2.9 billion, and a transaction value of USD6.6 billion when accounting for the assumption of net debt and operating lease liabilities.

Citigroup Global Markets Inc. Is serving as a financial advisor and Latham & Watkins, LLP is serving as a legal advisor to Frontier. Barclays and Morgan Stanley & Co. LLC are serving as financial advisors and Debevoise & Plimpton LLP is serving as legal advisor to Spirit.

The merger is expected to close in the second half of 2022, subject to satisfaction of customary closing conditions, including completion of the regulatory review process and approval by Spirit stockholders.

Update 2: On April 7, 2022, Spirit Airlines announced that its Board of Directors has determined, after consultation with Spirit Airlines's outside financial and legal advisors, that the unsolicited proposal received from JetBlue Airways to acquire Spirit in an all-cash transaction for USD33 per share could reasonably be likely to lead to a 'Superior Proposal' as defined in Spirit's merger agreement with FGH, the parent company of Frontier Airlines, Inc.

Spirit intends to engage in discussions with JetBlue with respect to JetBlue's proposal, in accordance with the terms of Spirit Airlines' merger agreement with Frontier.

Update1: On April 5, 2022, JetBlue Airways submitted an unsolicited proposal to acquire all of the outstanding shares of Spirit Airlines for USD33 per share in cash, implying a fully diluted equity value of USD3.6 billion and providing full and certain value to Spirit shareholders.

Yamato Merges with Yamato System Development and Yamato Web Solutions - 21 February

Yamato Holding Co Ltd, a provider of door-to-door parcel delivery services, has merged with Yamato System Development Co Ltd, a provider of computer system services and Yamato Web Solutions Co Ltd, a company providing help supply and personnel supply services. All the companies involved in the transaction are based in the Japan.

Venture financing

Skyports Secures USD23 Million in Series B Funding - 23 March ($23m)

Skyports Limited, a UK-based urban air mobility infrastructure (UAM) provider and drone delivery operator, has secured USD23 million in Series B funding from Deutsche Bahn Digital Ventures, Groupe ADP, Solar Ventus, Irelandia and Levitate Capital with a number materially increasing their stake. These investors were joined by Japanese conglomerate Kanematsu Corporation, global industrial property group Goodman Group, Italian airport platform 2i Aeroporti, backed by Ardian's Infrastructure Fund and F2i Italian Infrastructure Fund, and US based VC firm GreenPoint.

GOOD AID Secures USD2.34 Million in Series C Funding - 28 April ($2m)

GOOD AID Co Ltd, a Japan-based company engaged in businesses such as pharmacy, home-visit nursing and pharmaceutical ecommerce business, has secured JPY300 million (USD2.343 million) in Series C funding from Nagoya Railroad Co., Ltd., other independent VCs, and the number of individual investors.

Private equity

Inframobility UK Bidco (DWS Group) to Acquire Stagecoach Group - 09 March ($1,119m)

Inframobility UK Bidco Ltd (DWS Group), a company indirectly owned by a fund managed and advised by asset manager DWS Infrastructure, has agreed to acquire the entire issued and to be issued ordinary share capital of Stagecoach Group Plc, a UK-based provider of public transport services, at a price of GBP1.05 per share in cash for a consideration of GBP594.9 million (USD780 million).

The price is a 37% premium to Stagecoach's closing share price of GBP0.76 on March 8, 2022.

Earlier, Stagecoach Group has received takeover offer from National Express Group plc and the agreement has been terminated.

The offer will be open for shareholders to accept once the required documentation has been published and we would expect the acquisition to be completed in the first half of 2022.

Asset transactions

St. George Trucking & Warehouse (STG Logistics) Acquires Intermodal Division of XPO Logistics - 25 March ($710m)

STG CEO Paul Svindland and STG President and CFO Geoff Anderman will continue to lead the company. Current STG COO Todd Larson will lead the legacy STG operations as EVP of STG and COO of STG's Distribution segment, and Paul Smith, formerly President of XPO's intermodal division, will lead STG's intermodal operations as EVP of STG and COO of STG Intermodal.

NYK Line Sells Challenge Pegasus Tanker For US$13 Million - 08 April ($13m)

Nippon Yusen Kabushiki Kaisha (NYK Line), a subsidiary of Mitsubishi Group, has sold Challenge Pegasus tanker to Greek buyer, for a sale consideration of US$13 million.

The Challenge Pegasus is a 2007-built, Singapore-flagged Oil/Chemical tanker, with a gross tonnage of 30,029 tons and deadweight tonnage of 47,786 tons.

Mitsubishi And Nippon Yusen Kabushiki Kaisha To Acquire 45% Interest In Alexandre de Gusmao FPSO From SBM Offshore - 23 March

Mitsubishi Corp and Nippon Yusen Kabushiki Kaisha (NYK) have entered into a shareholder agreement to acquire a 45% interest in Alexandre de Gusmao FPSO from SBM Offshore, a company that engaged in designing, building, installing and operating offshore floating facilities.

Under the terms, Mitsubishi and NYK will acquire a respective 25% and 20% interest in the special purpose companies related to the FPSO. SBM Offshore is operator and will remain the majority shareholder with 55% interest.

The Alexandre de Gusmao FPSO is currently under construction and will be deployed at the Mero field in the Santos Basin offshore Brazil, 160 kilometres offshore Rio de Janeiro, under a 22.5-year lease and operate contract with Petroleo Brasileir SA (Petrobras).